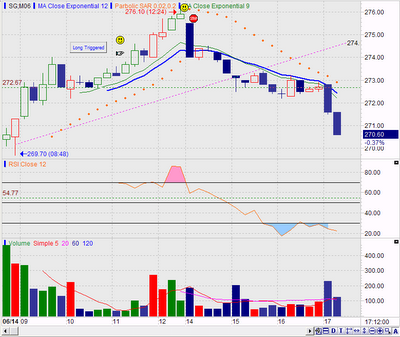

So we have seen a strong rally last Friday. It was expected to hear some voices in forums discussing 'Bull is back to action'. Well, I have decided again to do some analysis on the trend. And this time, I want do something interesting.

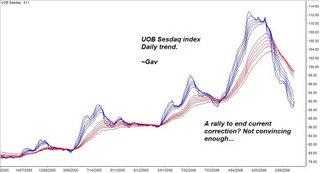

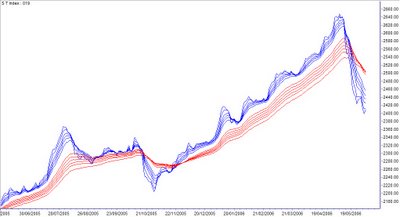

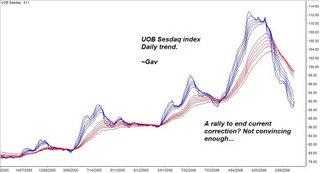

Firstly, I am looking at daily trend of UOB Sesdaq index. Last week's rally put a pause to the heavy selling. Short term moving averages are ticking up. However, it is still far below long term moving averages. And there is, in fact, nothing much in term of trend change. Downtrend is still intact.

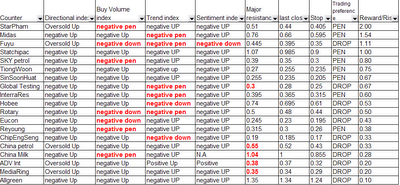

From Directional analysis, negative sentiment is still hanging in the air, though it was ticking down at the end of last week, I do not see positive sentiment gaining strength.

(Click on the chart to maximize it)

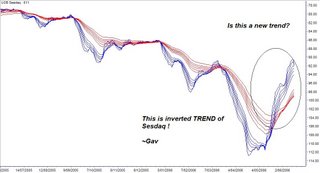

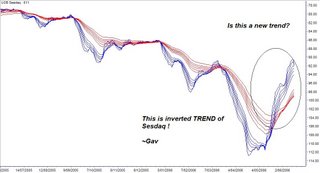

If it is a little bit tough for trader to accept establishment of downtrend (Since, most of traders only recognize Bullish pattern), I have inverted the daily trend of UOB Sesdaq. The inverted trend indeed showing me a 'BUY' opportunity (in reality, a SELL, remember, this is a inverted chart) if I were to do

trend trading.

In fact, I am not impressed by the rally. Maybe, at least for now. My strategy will be sell on strength instead. The rally in some way, provides a chance to let go current holding of small cap.