Sunday, July 30, 2006

Better Trading Blog has moved!

Friday, July 28, 2006

Dummy day trading 28-Jul-2006

Thursday, July 27, 2006

Re: Dummy day trading 27-Jul-2006

Dummy day trading 27-Jul-2006

Wednesday, July 26, 2006

Dummy day trading 26-Jul-2006 II: Mini Dow

Dummy day trading 26-Jul-2006

Tuesday, July 25, 2006

RE: Dummy day trading 25-Jul-2006

Dummy day trading 25-Jul-2006

Monday, July 24, 2006

Change

TIMSCI 24-Jul-2006: Short Trade closed

Short position of MSCI Taiwan index futures (TIMSCI) was established at 259.1. Initial stop loss 259.6 was triggered with 1-R loss.

"The wrong way to play it would be to attempt to “pick a bottom,” or fade the market; blindly enter short without waiting for a good spot; getting short without setting a stop, etc. The list of errors goes on and on, but people mainly make those three big mistakes.

Traders who know themselves, who have common sense, who are disciplined, and who have the ability to keep it simple will do just fine. Remember that many people in the market are either uneducated or uninformed. And most of the few who are educated and informed waste their time building “scenarios” and end up defeating themselves by trying to outsmart the market."

- Maoxian

Short position of MSCI Taiwan index futures (TIMSCI) was established at 259.1. Initial stop loss 259.6 was triggered with 1-R loss.

"The wrong way to play it would be to attempt to “pick a bottom,” or fade the market; blindly enter short without waiting for a good spot; getting short without setting a stop, etc. The list of errors goes on and on, but people mainly make those three big mistakes.

Traders who know themselves, who have common sense, who are disciplined, and who have the ability to keep it simple will do just fine. Remember that many people in the market are either uneducated or uninformed. And most of the few who are educated and informed waste their time building “scenarios” and end up defeating themselves by trying to outsmart the market."

- Maoxian

Day trading watch list: 24-Jul-2006

| Intraday Trend | MSCI Taiwan Index Futures | MSCI Singapore Index Futures |

| Longer term | Down | Down |

| Medium term | Down | Down |

| Short term | Down | Down |

| Recent High | 261.1 | 278.8 |

| Recent Low | 256.4 | 276.8 |

| Trading direction | Short | Short |

Saturday, July 22, 2006

Mini Dow & Gold futures: Short opportunities.

Gold reversed its initial movement after positive opening. Intraday trend turned down. Shorting opportunity apeared.

Gold reversed its initial movement after positive opening. Intraday trend turned down. Shorting opportunity apeared.

Friday, July 21, 2006

Day trading II : 21-Jul-2006

| Intraday trend | Mini Dow | Gold Futures |

| Intermediate term | Down | Up |

| Short term | Down | Up |

| Recent High | 11026 | 644.5 |

| Recent Low | 10826 | 621.2 |

Chop! 21-Jul-2006

Day trading 21-Jul-2006

| Intraday trend | MSCI Taiwan Index Futures | MSCI Singapore Index Futures |

| Long term | Lateral | Lateral |

| Intermediate term | Lateral | Lateral |

| Short term | Lateral | Down |

| Recent High | 267.8 | 284.4 |

| Recent Low | 262.8 | 276.8 |

Thursday, July 20, 2006

No trade 20-Jul-2006

Day trading 20-Jul-2006

| MSCI Taiwan Index Futures | MSCI Singapore Index Futures | |

| Longer term | Down | Lateral |

| Medium term | Up | Up |

| Short term | Up | Up |

| Recent High | 265.9 | 287.1 |

| Recent Low | N.A | N.A |

Wednesday, July 19, 2006

Lecture notes series: Percent Risk Model

I developed a habit of writing down whatever I learnt, this helps me to 'burn' the information into my mind. I did this during my school time as well. I decided to jot down what I have read from books so far in Lecture Note series. As mentioned in my previous posting, I am following Percent Risk Model for my position sizing. Of course, this is not the only model available, it is just the approach I applied in my business. I have amended the approach to suit my style. Basically, I will define initial stop level base on chart. It can be support/resistance level, straight trend line, Count back line or swing high/low.

Definition:

RISK - the point at which I will get out of the position in order to preserve my capital. It is x percent of my trading equity, for example, I will risk not more than 2% of trading equity in any trade.

Percent Risk Model - Controlling my position size as a function of the risk.

For example, with account size of $50,000, 2% of $50,000 is $1000. That means in any trade, I shall not risk more than $1000 with this account size.If I got a Long signal for SIMSCI at 289 and I have figured out from chart, proper stop loss level is at 287.5. On one contract basis, this trade requires $300 risk. With maximum risk amount $1000 available to me, I will be able to buy ($1000/$300=3.33) 3 contracts in this trade.

I quote a portion of Dr. Van Tharp's explaination from his book

'Just how much risk should you accept per position with risk position sizing? Your overall risk using risk position sizing depends upon the size of the stops you've set to preserve your capital and the expectancy of the system you are trading.'

Here goes on the explaination :

'if you are trading other people's money, you probably should risk less than 1 percent per position. If you are trading your own money, your risk depends upon your own comfort level. Anything under 3 percent is probably fine, if you are risking over 3 percent, you are a "gun-slinger" and had better understand the risk you are taking for the reward you seek.'

He explained the relationshiop with system expectancy as well:

'if you have high expectancies in your system (i.e your reliability is above 50% and your reward to risk ratio is 3 or better), then you can probably risk a higher percentage of your equity fairly safely'.

The percent risk model is the first model that gives trader a legitimate way to make sure that a 1-R risk means the same for each item he is trading. The advantage of this model is, it allows both large and small accounts to grow steadily. It equalizes performance in the portfolio by the actual risk. On the other hand, the disadvantage will have you to reject some trades because they are too risk.

Trading Business plan 101

| MSCI Taiwan Index Futures | MSCI Singapore Index Futures | |

| Longer term | Down | Down |

| Medium term | Lateral | Lateral |

| Short term | Up | Up |

| Recent High | ||

| Recent Low |

Futures trading 19-Jul-2006

Tuesday, July 18, 2006

Market recap 18-Jul-2006

Nothing much about UOB Sesdaq. Still ding-dong between 50-day and 200-day moving averages. Just be patient to watch for development during this result relaesing season. Recent low is around 90 area. I am interested in looking at Short side if the support area is broken.

Nothing much about UOB Sesdaq. Still ding-dong between 50-day and 200-day moving averages. Just be patient to watch for development during this result relaesing season. Recent low is around 90 area. I am interested in looking at Short side if the support area is broken.

RE: TIMSCI 18-Jul-2006: Short trade closed

It seems like things were not going so well with me this week. Yup, another losing trade today. Short position of TIMSCI was established at 255.6, stop loss has been moved accordingly and it was triggered at 256.8 at the last trading hour of MSCI Taiwan Futures for the day. It seems to be a strong intraday support at 256.5 area. Even with -300 points loss in Nikkei, TIMSCI was still holding well. Is this a force of rebound after previous days' losses? No idea.

Anyway, there is nothing much I can do other than exit the trade if things are not working in my favour. One trade closed with -1.2 point loss (-0.89R).

This should be the only trade of the day. I will be spending my time reading for the rest of the day.

It seems like things were not going so well with me this week. Yup, another losing trade today. Short position of TIMSCI was established at 255.6, stop loss has been moved accordingly and it was triggered at 256.8 at the last trading hour of MSCI Taiwan Futures for the day. It seems to be a strong intraday support at 256.5 area. Even with -300 points loss in Nikkei, TIMSCI was still holding well. Is this a force of rebound after previous days' losses? No idea.

Anyway, there is nothing much I can do other than exit the trade if things are not working in my favour. One trade closed with -1.2 point loss (-0.89R).

This should be the only trade of the day. I will be spending my time reading for the rest of the day.

Futures trading 18-Jul-2006

Market recap 17-Jul-2006

UOB sesdaq is on the line. It stays around on 50-day moving averages. It is likely for Sesdaq to ding-dong between 50-day and 200-day moving averages. Not so good for small cap, but I am not over bearish. I guess, a little bit patience is needed.

UOB sesdaq is on the line. It stays around on 50-day moving averages. It is likely for Sesdaq to ding-dong between 50-day and 200-day moving averages. Not so good for small cap, but I am not over bearish. I guess, a little bit patience is needed.

RE: TIMSCI 17-Jul-2006: Short trade closed :chart

This is 15-min chart of MSCI Taiwan Index Futures (TIMSCI). It was easy to observe price set-ups were all for Short. I entered with entry and missing out good profit and taking silly losses.

I have been reading money management stuffs from Van Tharp and other web blogs. Thanks to TraderMike who has a well written entry on Position sizing. I am practising R-Multiples as introduced by Dr.Van Tharp for position sizing and evaluate my system expectancy.

Basically, the idea is to express all of my profits and losses in terms of my initial risk(R).

For example, if my risk for each trade is $300, then if I made $3000, then I have 10R gain. On the other hand, if I closed my trade with $150 loss, then I will have an 0.5R loss.

I learnt about the concept of expectancy. To make it simple, expectancy is the average amount you can expect to win(or to lose) per dollar at risk. Here is the formula:

This is 15-min chart of MSCI Taiwan Index Futures (TIMSCI). It was easy to observe price set-ups were all for Short. I entered with entry and missing out good profit and taking silly losses.

I have been reading money management stuffs from Van Tharp and other web blogs. Thanks to TraderMike who has a well written entry on Position sizing. I am practising R-Multiples as introduced by Dr.Van Tharp for position sizing and evaluate my system expectancy.

Basically, the idea is to express all of my profits and losses in terms of my initial risk(R).

For example, if my risk for each trade is $300, then if I made $3000, then I have 10R gain. On the other hand, if I closed my trade with $150 loss, then I will have an 0.5R loss.

I learnt about the concept of expectancy. To make it simple, expectancy is the average amount you can expect to win(or to lose) per dollar at risk. Here is the formula:

Monday, July 17, 2006

RE: TIMSCI 17-Jul-2006: Short trade closed

Day trading for 17-Jul-2006

Sunday, July 16, 2006

Article read: Master the Four Fears of Trading

Friday, July 14, 2006

TIMSCI 14-Jul-2006: Short trade closed: Chart

RE:MSCI Taiwan index futures (TIMSCI) 14-Jul-2006: Short trade closed

MSCI Taiwan index futures (TIMSCI) 14-Jul-2006: Short position

From 15-min chart, downtrend is established. MSCI Taiwan index futures (TIMSCI) is trading below 12-p, 21-p and 30-p EMA. I am only looking for SHORT position. Short position has been established at 263.8. I have removed all indicators but moving averages to keep myself clear and focus on price action and trend only. I do not expect this decision to deteriorate trading performance. Though I would say, I am still practising this approach. Intraday support area is found at area of 262.

I do not trade SIMSCI futures today, given first hour volume is only around 1,500 contracts traded.

Trading for 14-Jul-2006: Potential shorts

Traders who know themselves, who have common sense, who are disciplined, and who have the ability to keep it simple will do just fine. Remember that many people in the market are either uneducated or uninformed. And most of the few who are educated and informed waste their time building "scenarios" and end up defeating themselves by trying to outsmart the market. '

Trading should be simple. Really, it should be.

Thursday, July 13, 2006

Confession

RE: SIMSCI 13-Jul-2006: 2nd Short trade closed

RE: SIMSCI 13-Jul-2006: Short trade closed

RE: SIMSCI 13-Jul-2006: Short position.

SIMSCI 13-Jul-2006: Potential swing up

Wednesday, July 12, 2006

RE: SIMSCI 12-JUL-2006: No trade

The result of guarding the quality of my trading, no trade was made today. It was a choppy day with low volume, I would say. Day volume is just more than 3000 contracts. There were selling at the end of morning session , however, sellers strength were weak. In the afternoon session, though SIMSCI futures started rebounding, a possible entry was at 289.1.

I saw few levels of resistance. None of my setup was completed. No trade was done.

The result of guarding the quality of my trading, no trade was made today. It was a choppy day with low volume, I would say. Day volume is just more than 3000 contracts. There were selling at the end of morning session , however, sellers strength were weak. In the afternoon session, though SIMSCI futures started rebounding, a possible entry was at 289.1.

I saw few levels of resistance. None of my setup was completed. No trade was done.

SIMSCI 12-JUL-2006

Tuesday, July 11, 2006

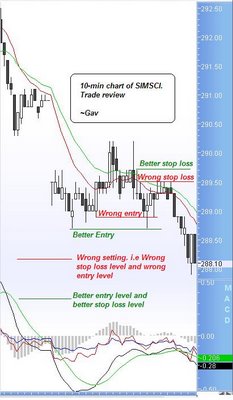

SIMSCI Trade recap 11-JUL-2006

After reading the chart retrospectively, mistakes were found. Mistakes were found in the second trade. While for first trade, false breakout is expected portion of breakout trading.

In the second trade, stop loss calculation was wrong, instead of 289.5, correct stop loss level should be at 289.7, if short entry was at 288.9. This is merely a chart reading mistake.

Another mistake was found at entry level. Since day low/high serves as support/resistance level most of time, short position should be place below day low which was 288.7, instead of 288.9. I was too eager to establish short position.

After reading the chart retrospectively, mistakes were found. Mistakes were found in the second trade. While for first trade, false breakout is expected portion of breakout trading.

In the second trade, stop loss calculation was wrong, instead of 289.5, correct stop loss level should be at 289.7, if short entry was at 288.9. This is merely a chart reading mistake.

Another mistake was found at entry level. Since day low/high serves as support/resistance level most of time, short position should be place below day low which was 288.7, instead of 288.9. I was too eager to establish short position.

RE: SIMSCI 11-JUL-2006: 2nd trade: Short trade closed

It is indeed not so good day to me. I have two losing trades today. Second trade was a SHORT on SIMSCI at 288.9. After the spike of afternoon session opening, SIMSCI looked weak.

Trailing stop was moved to 289.5 and triggered. Instead, a 'W' bottom is in the making and RSI starts making higher lows and MACD moving above trigger line.

Second trade closed with -0.6 point loss.

Trade summary:

Direction: Short

Entry: 288.9

Exit: 289.5

P/L: -0.6 points.

That's all for the day. No trade will be made to avoid any potential emotional trading.

It is indeed not so good day to me. I have two losing trades today. Second trade was a SHORT on SIMSCI at 288.9. After the spike of afternoon session opening, SIMSCI looked weak.

Trailing stop was moved to 289.5 and triggered. Instead, a 'W' bottom is in the making and RSI starts making higher lows and MACD moving above trigger line.

Second trade closed with -0.6 point loss.

Trade summary:

Direction: Short

Entry: 288.9

Exit: 289.5

P/L: -0.6 points.

That's all for the day. No trade will be made to avoid any potential emotional trading.

RE: SIMSCI 11-JUL-2006: Long position: Trade closed

It was a disappointed trade. Nikkei failed to push up further, instead, it formed a lower high, which does not look good to me. I have exited Long position of SIMSCI at 289.7. Initial stop loss was at 289.3.

One trade closed: -0.2 loss

Trade summary:

Direction: Long

Entry: 289.9

Exit: 289.7

P/L: -0.2

It was a disappointed trade. Nikkei failed to push up further, instead, it formed a lower high, which does not look good to me. I have exited Long position of SIMSCI at 289.7. Initial stop loss was at 289.3.

One trade closed: -0.2 loss

Trade summary:

Direction: Long

Entry: 289.9

Exit: 289.7

P/L: -0.2

RE: SIMSCI 11-JUL-2006: Long position

SIMSCI 11-JUL-2006

Monday, July 10, 2006

Futures market recap 10-JUL-2006

It was a roller coaster day for SIMSCI. Afternoon session opened with a spike after Nikkei futures gained around 200 points. However, the upward running was not sustainable. Afternoon session did not provide opportunity for short entry for day trading as well. The selling in the afternoon session was supported by volume, which eventually gave back all the gain in the earlier session.

It was a roller coaster day for SIMSCI. Afternoon session opened with a spike after Nikkei futures gained around 200 points. However, the upward running was not sustainable. Afternoon session did not provide opportunity for short entry for day trading as well. The selling in the afternoon session was supported by volume, which eventually gave back all the gain in the earlier session.

SIMSCI 10-JUL-2006: Morning trades: chart

RE: SIMSCI 10-JUL-2006: Second trade: Long trade closed

RE: SIMSCI 10-JUL-2006: Second trade: Long

RE: SIMSCI 10-Jul-2006: Long position: Trade closed

RE: SIMSCI 10-Jul-2006: Long position

SIMSCI 10-JUL-2006

Friday, July 07, 2006

RE:SIMSCI 07-JUL-2006:2nd trade: Long trade closed

SIMSCI 07-JUL-2006: 2nd trade : Long position

RE: SIMSCI 07-JUL-2006: Short position Closed.

RE:SIMSCI 07-Jul-2006: Short position

SIMSCI 07-JUL-2006

Thursday, July 06, 2006

Take stock 07-Jul-2006

RE: SIMSCI 06-Jul-2006: Long trade closed.

RE: SIMSCI 06-JUL-2006: Potential long

RE:SIMSCI 06-Jul-2006: Long trade missed

SIMSCI 06-Jul-2006

Wednesday, July 05, 2006

RE: SIMSCI 05-Jul-2006: Short trade closed

RE: SIMSCI 05-Jul-2006: Potential short

SIMSCI 05-Jul-2006

Tuesday, July 04, 2006

RE: SIMSCI 04-Jul-2006: Long trade closed

SIMSCI 04-Jul-2006: Potential Long

Monday, July 03, 2006

RE: SIMSCI 03-Jul-2006: Short position: Trade closed

It was not a good trade. My initial target of 290.5 was not achieved. Market is pretty resillent, but not strong enough for me to go long, yet. I have closed my short position at 291.3 after seeing Nikkei back to +120 gain and RSI of SIMSCI making higher lows again. Short position closed with +0.1 points gain.

This SIMSCI Futures 10-min chart of morning session.

It was not a good trade. My initial target of 290.5 was not achieved. Market is pretty resillent, but not strong enough for me to go long, yet. I have closed my short position at 291.3 after seeing Nikkei back to +120 gain and RSI of SIMSCI making higher lows again. Short position closed with +0.1 points gain.

This SIMSCI Futures 10-min chart of morning session.