There were few postings on Traderswin stocks trading blog targeting on shorting candidates over the past few days. From BeautyChina, HTL Intl to StatsChipac , Datacraft and DMX tech. With the negative market sentiment, these counters are currently moving our favour. I have quoted some rules for short selling from Leon Wilson, a outstanding Australian private trader. In SG market, short selling is to be done through trading CFD.

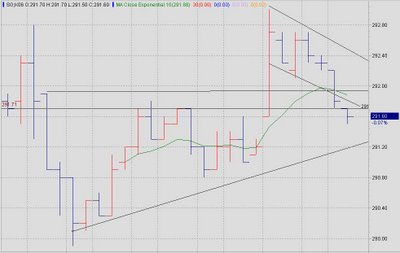

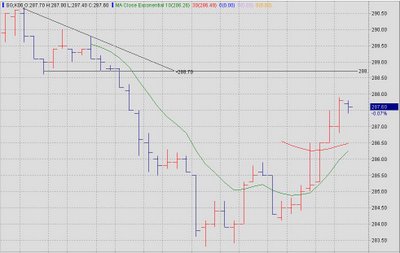

#1 Do not short trade a position that does not show clear signs of suitable short term downward momentum

#2 Do not take a short position immediately above a significant line of support

#3 Trade securities which you are familiar with and markets that you can gain access to with little effort

#4 Price action of underly security is below the long term moving average

#5 Have the discipline to act when required, as CFD trades should never become investments.

To me, #5 is the most important rule. Risk and money management is always on the top of all trading techniques. CFD is , in fact, a bucket shop product. We are trading with the CFD providers. CFD providers are there to make profit from traders. Another important note is to choose the right stock for short selling. As I believe, during the bullish market, sky is the limit of rising share price. There is nothing called 'over valued' stock. With this in mind, I will only short sell stocks which are trading below 150-day and even better 200-day moving averages. This puts me in a better position to deal with short selling. As the stocks are weak and price action is below long term moving average, the chance of the share price to sky rocket overnight is minimal.

Take care of the risk involved in short selling, clearly understand our trading approach, we are on the way to make profit in the bear market as well.